Opportunity to Acquire Massively Under-Monetized Platform Business at Nice Price

Periodically I will share investment ideas or observations I find interesting. If stocks or private investing is something you find interesting, please enjoy. This is not investing advice and I may maintain positions in the securities discussed.

I assembled a write-up on WM Technology (NASDAQ:MAPS) back when it was in the process of finalizing its SPAC merger with Silver Spike Holdings (May 2021). You can follow this link to the original write-up which has been posted here on my website. At the time, the stock was trading in the $14-$15/share context, and my thesis was MAPS represented a more compelling opportunity at ~$7/share.

At time of writing this post, MAPS has been bouncing around in the ~$5-6/share context, a rocky descent (~60%) in the last 6 months. The lion's share of this decline came on the heels of the Company's Q3 '21 results which were published in November '21 and featured unexpected flat sequential revenue guidance and compressed EBITDA margins for Q4 '21. Before wading a little deeper, here is a brief synopsis & refresh on the company for those new to the name.

Refresh: WM Technology is corporate shorthand for Weedmaps, the leading two-sided marketplace serving the U.S. & Canadian cannabis industry (think Yelp as a business model analog). Weedmaps has a comprehensive platform with listing pages for all licensed dispensaries across the U.S. Cannabis users come to the Weedmaps website to find deals on their favorite products, access a wide database of reviews and order cannabis for pick up or delivery.

Weedmaps is at its core an advertising business. Advertising revenue from dispensary customers drives ~75% of the top-line at MAPS. The Company has monthly active user base (MAUs) of ~14mm, is generating ~$200mm of run-rate revenue, Adj EBITDA margins of ~20% and is generating positive FCF (no real capex) despite aggressively investing in future growth. The current ~$6/share price creates an Enterprise Value (EV) of ~$1bn, implying run-rate multiples of 5x Revenue and 25x EBITDA.

Ok, so why is this trade interesting to me now? Just a few months ago, I was breaking down the math on legalization and the long growth wave MAPS is positioned to ride. That narrative on legalization is still very real and promises to provide powerful tailwinds for MAPS over the next decade as individual states continue to legalize recreational use. But recently I've been reflecting more on existing customer economics, which has revealed what I believe is 'another way to win' with this trade given the significant under-monetization of the platform as it stands today.

MAPS current go-to-market strategy for its advertising is selling fixed monthly subscriptions for 'Featured Listings' and 'Banner Ad' slots, primarily. The market leading ad platforms today (Google & Facebook) use a cost-per-click (CPC) model (not monthly subscription) which allows them to monetize each user interaction individually (versus trying to reverse engineer a monthly subscription price based on MAPS forecasted user traffic). A CPC ad model is much more effective at monetizing user traffic, but requires a more complex tech stack to support the auction-style mechanics used by advertisers to set their price per click bids. MAPS is investing in its tech stack to enable this switch to CPC monetization and mgmt has claimed they are currently testing functionality in select markets.

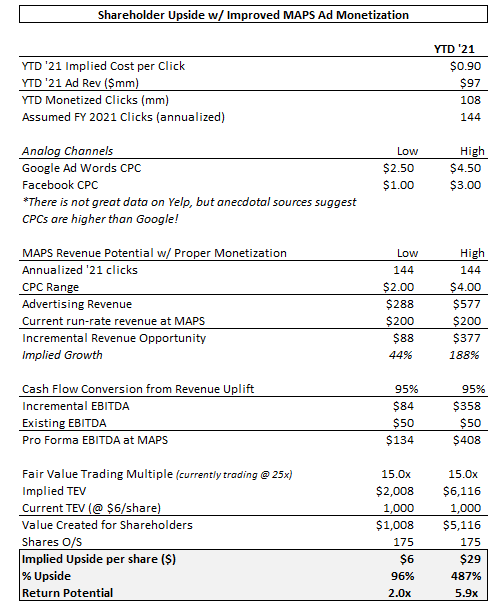

Here's why this matters: currently MAPS subscription-based advertising business is generating revenue at an implied $0.90 CPC according to earnings call disclosures. As MAPS ad monetization tech stack improves, MAPS has potential to monetize its traffic at much higher rates ($2-$3+ per click). Looking at FB and Google Ad words CPC for analog industries shows the median cost per click in this $2-4 range. Weedmaps is aggregating traffic for a very niche audience with much higher purchase intent (higher conversion rates) which 'should' translate into more premium CPCs than a top-of-funnel search engine or social network. This thesis is still yet to be proven. But if we assume that MAPS can bring their advertising monetization up to market levels, the potential is jaw-dropping. CPC uplift could add anywhere between $6 to $30 of value per share (100-500% upside), aided by the fact that this additional revenue brings near zero additional cost (100% free cash flow through). Here is a snapshot of the math outlining the point made above:

This upside is not reliant upon legalization trends, broader consumer adoption or the ongoing consumption shift from illegal to legal channels. All the these trends are certainly bullish for MAPS economic picture, but the upside math above is purely driven by execution at MAPS by fixing their monetization constraints.

These are the bets I find particularly interesting. Even if it turns out I'm completely wrong on the advertising potential at MAPS, you still own a business at a reasonable price which is well positioned to ride the wave of U.S. legalization, with multiple upside catalysts (marketplace transaction fees, international expansion and private label sales).

What is the downside here? Its not zero, but I think its fairly well truncated. The business is self-funding its growth (FCF positive today) with no debt, so the risk of a zero (i.e., bankruptcy) seems remote. A realistic downside here could be a deceleration of revenue growth which compresses multiples further, but can't imagine this business going lower than ~$3/share (~10x run-rate EBITDA multiple for a very compelling business) given the secular industry growth and margin structure of the advertising segment.

So in conclusion, with an upside/downside price target of $15/$3, given the $6/share current price, I'm looking at a $9/($3) of upside/downside potential or expressed simplistically, I get $3 if right, and lose $1 if wrong (I wish Vegas had odds like this.)

In reality, the odds may be even better because this summary assumes the upside case and downside case are both equally likely to occur. I would argue that MAPS (clear market leader) who is actively testing its new advertising tech has a greater than 50% chance of getting monetization figured out. Nonetheless, time will tell how right or wrong my thesis is, but I see MAPS as an interesting asymmetric trade which deserves space in my portfolio. Look forward to updating you how this plays out as I learn more.

If you have questions or want to discuss the name in general, shoot me a note. I respond to email. Hope to bring around interesting ideas in the future, and look forward to sharing any learnings from this trade with you as time goes on.

If you are enjoy receiving content like this, hit the subscribe button to have future posts delivered directly to your inbox

Stay Tuned, Ryan

P.S. - As a bold request of anyone reading... my vision this year is to reach an audience of 5,000 people. If you know anyone who may like this article or if you have advice on strategies to reaching this goal, I'd love your input!