Friday🔥08: Zeroing in On Zillow

Welcome to the -- new additions to our Friday 🔥 community who have joined us since last week! If you aren't subscribed, join >100 smart & curious folks here:

Welcome to this week's edition of Friday Fire, an end of week newsletter recapping notable insights and inspirations from the past week. This week I'm unpacking my thoughts on Zillow Group stock and the puts/takes at current price levels.

If there is a stock you're curious about or one in your portfolio you'd like me to breakdown, send me a note about it. I'll consider incorporating into a future article which will make the writing and reading more fun for both of us :)

Let's jump in!

Zillow - A Long Way Down

TLDR: Zillow is still very much a world-class business with an insane TAM and margin structure to-boot. Housing market headwinds may continue to send this stock trading lower into "steal" territory.

What is going on at Zillow (ticker: Z & ZG)?? The company’s stock peaked back in February 2021 at ~$200 per share.

Today Zillow Group trades at ~$47, a dazzling 77% decline. Yikes!

Before I get going, an aside for the readers - I wish like hell there was time in my schedule to do a deep dive on every company I find interesting, but I'm coming to accept that between my day job, side business, my lovely wife and dog – there are only so many hours in the day. As someone who comes from a traditional investing background, its important for me to publicly acknowledge – I am far from the “smartest guy in the room” on the names I’m writing about here. There just isn’t enough bandwidth for me to go as deep in research as I would otherwise like. As such, these write ups are summary in nature. These posts cover setups I find interesting (based on several hours of research) and are hopefully presented in a way that is information dense and mildly entertaining.

With that context in mind – let’s step through the fascinating dynamics at Zillow and why I think this is a name deserving to be at the top of a watch-list.

How Zillow's Business Works

I would wager every single reader knows the name Zillow, which is a pretty startling bet. This business has permeated the U.S. and is a beloved consumer product. Currently, Zillow has ~200mm monthly active users (MAUs)... which for those of you who are sleep-reading, is ~75% of the adult population (18+). Mind Boggling!

Zillow Group has 3 primary segments which I am going to simplify for the sake of easy reading:

(i) Premier Agent & Rentals – Zillow sells advertising to real estate agents in local markets which drive leads of potential new homebuyers and sellers to agents. This segment also has similar advertising-based products for the home/apartment rental space. This segment is the “Core” business at Zillow, drives 31% of revenue and 100% of EBITDA. EBITDA Margins on this business are in the whopping 30-45% context, depending on one’s accounting interpretations. More on this later.

(ii) Zillow Offers – Zillow purchases homes directly from sellers with the intent to ‘fix & flip’ the home in ~3-9 months. This segment drives 73% of revenue and is money-losing business at its current scale. This business line is an absolute dog, and part of the thesis for why there is go-forward opportunity at ZG.

(iii) Mortgages & Other – Zillow offers home loans (new purchase and refinancing) along with other closing services. This business represents ~3% of revenue today, is flirting with breakeven profitability and is growing like a weed (40% YoY)

Zillow's Competitive Position (The 30,000 Lb Gorilla)

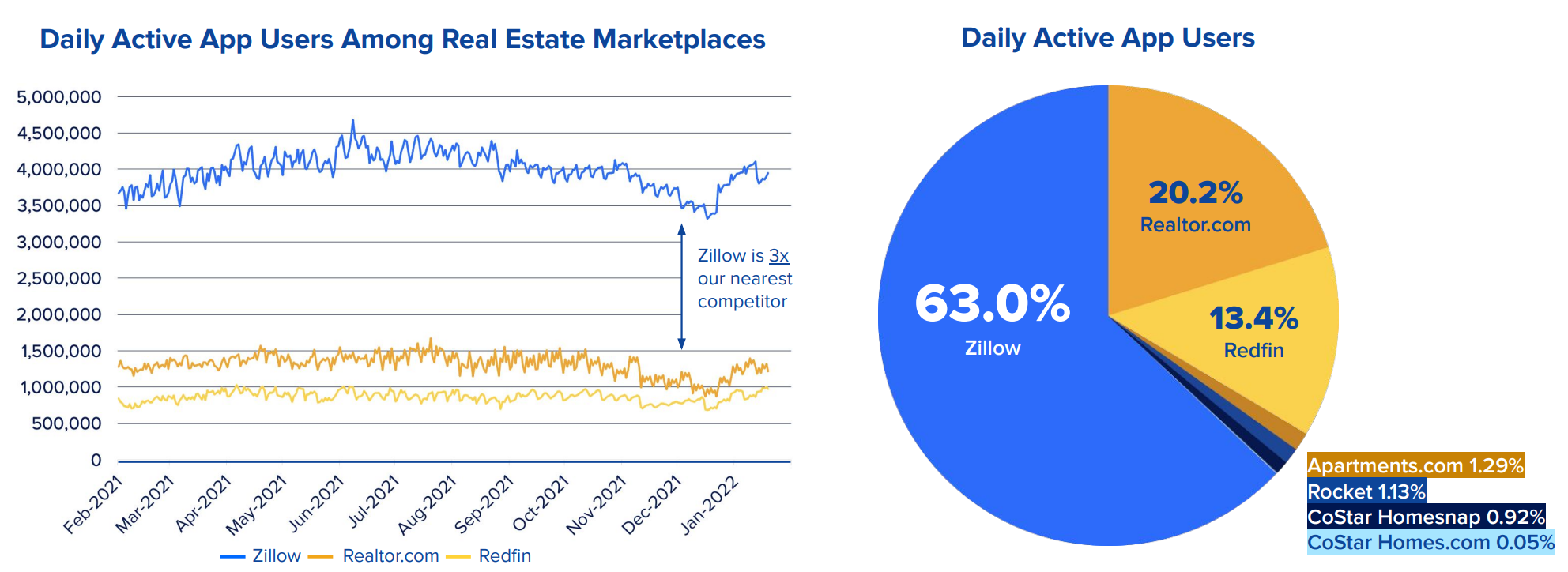

There aren’t many verticals where the market share dominance is as profound as it is in the case of Zillow. Zillow has 2 primary competitors, Redfin and Realtor.com. If you’ve ever visited either of these sites, you’ll feel the UI/UX differences almost immediately. Unfortunately for the competitors, the optimal time to establish the consumer-facing brand has come and gone. Zillow is the clear category captain with 3x more monthly users than its peers. An eye-opening for you - it turns out the term “Zillow” is searched for more on Google, than the term “Real Estate”. Insane!

We can think of Zillow with similar reverence as other dominant consumer products (Q-tip, Kleenex, Clorox, Google, Uber, Coke). Here are a few graphics which illustrate the chasm between Zillow and the rest of the field.

American consumers have created a powerful association link between real estate and the Zillow platform, and that can’t be disrupted over night. It would take years of marginal erosion and missteps by Zillow to give up this lead.

This position enables Zillow to launch, test and scale new products faster and with higher returns on capital given the consumer audience advantage. I'll outline this a bit more below.

Now, with a bit of background on the business, let’s examine the current stock setup:

The Setup

As I see it, there are 3 key topics framing the current equity setup at Zillow:

1) Zillow Offers Wind-Down

The latest news from Zillow in November 2021 is that they were getting out of the Zillow Offers (home-flipping) business. Thank God. This Zillow Offers business has kept me at "meh" status on this stock since the initiative was announced in 2018.

Personal aside: I remember working in the halls of Moelis & Co when I heard about this initiative. At the time I was advising one of Zillow’s competitors on a deal when this news came out, and without hesitation, every deal team member collectively gasped, "Why the hell is Zillow getting into flipping houses??"

Regardless of Zillow's thesis at the time, after 3.5 years, the experiment is done. Zillow torched ~$500mm+ of capital and is now re-focusing on its highly profitable Core business lines beginning in Q3 this year which will bring a return to profitability.

2) Housing Market Headwinds

Zillow is staring down the barrel of an over-heated housing market. 30-yr mortgage rates have spiked to 4.9% (vs 3.25% back in December '21) which is beginning to leak into home sales activity numbers which were down ~7% MoM in February.

The knock-on effect for Zillow is a rising interest rate environment will clamp down homebuyer demand which almost certainly leads to a throttling of ad spend by real estate agents (Agents won't spend the same ad $ at lower implied cost per lead). This dynamic also spills over into Zillow’s mortgage business which will experience lower origination volumes and unfavorable mortgage spreads (in a rising I/R environment) when they go to sell those loans to Fannie & Freddie.

3) Profitable Core Business Drives Penetration of Massive TAMs

Despite the tepid macro outlook, I can’t ignore Zillow’s compelling Core biz. The Premier Agent business is growing nicely (30% in 2021) and the more nascent products like Mortgages and Closing Services, while small, are growing fast (40% and 20%, respectively). There still remains plenty of runway for this business as it continues to penetrate its massive real estate services TAM. A quick walk through of the business funnel will help orient the opportunity:

Zillow has so many ways to win:

1) They can drive higher connection requests (23% figure above)

2) Convert more connected buyers into transactions at the bottom of the funnel (6% figure).

3) Zillow can also expand its Revenue per Customer Transaction by cross selling mortgage loans and closing services to its homebuyer users which provide a one-stop-shop real estate experience for the consumer (i.e., you can go on Zillow to book a tour, find an agent, get a loan, and manage the closing process).

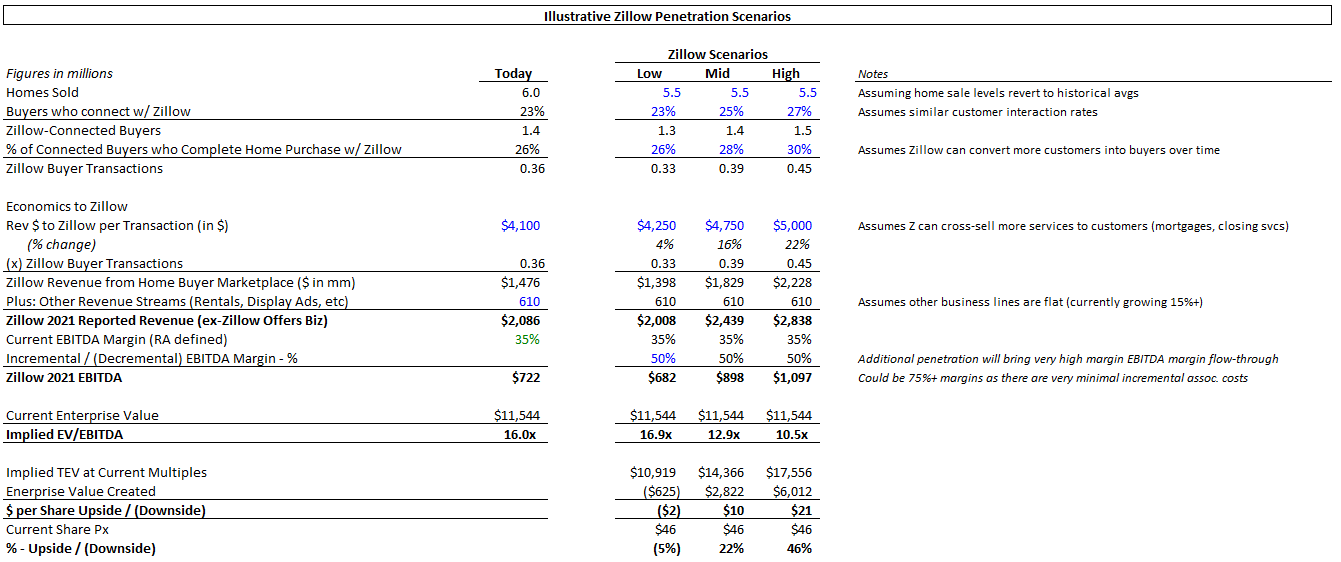

Below is a table laying out the math of where Zillow could go in the next ~3-5 yrs.

What you’ll see is that small improvements in penetration rates can lead to significant windfalls and upside for Zillow shareholders. This simple math factors in an ~8% decline in home sales from blistering 2021 levels, and conservatively assumes new revenue coming online at 50% EBITDA margins (in reality these revenue streams are probably closer to 75%+ contribution).

Conclusion

Zillow is a fascinating setup where a high-growth, category leading company has been stung by: (i) a market correction in growth stocks, (ii) being placed in the penalty box by investors for the bath it took on the 'Zillow Offers' business and (iii) faces near-term economic uncertainty in the form of a contracting housing market.

I personally think there is still more room for this stock to fall throughout Q2 of this year as financials will still be messy from the Zillow Offers segment wind-down, and potential top-line disruption from agents holding back ad spend.

I’m going to eagerly track this name and see if there is an opportunity to acquire this world-class business with superior margins south of the current ~18x EBITDA valuation mark.

Gratitude

Gratitude helps cultivate a sense of joy and appreciation along the way, and need not be reserved for the big or elaborate happenings in life.

This week I'm grateful for the opportunity to meet my co-workers after ~2 yrs of remote work.

What are you grateful for this week?

Update on Stock Picks:

Weekly performance update below for active stock picks

If you enjoyed this, please share with 1 person you think may enjoy it too! It'd mean a lot to me!

Until Next Week,

Ryan ✌️