Friday🔥05: Foot Locker (A Goody-Two-Shoes?)

Welcome to the -- new additions to our Friday 🔥 community who have joined us since last week! If you aren't subscribed, join >100 smart & curious folks here:

Welcome to this week's edition of Friday Fire, an end of week newsletter recapping notable insights and inspirations from the past week. This week I'm unpacking the recent developments at Foot Locker and seeing 'if the shoe fits' as a potential investment given the recent 30% drop in the Company's stock price. Let's jump in!

Foot Locker

TLDR: Foot Locker suffered a crisis of conscious in its key supplier relationship with Nike. While the core retail business at FL is unremarkable, aggressive capital allocation, low leverage and 'hidden value' from minority investments make Foot Locker an intriguing trade.

I cannot believe I'm entertaining the notion of adding a dusty, old retailer like Foot Locker ("FL") to my portfolio! In the distressed investing space where I currently work, I've seen many investors lose their shirts investing in retailers because they built a cozy narrative around why 'this company is different'. Perhaps I'm not learning from their mistakes, or, perhaps pessimism surrounding this company has run amok, providing a buying opportunity.

For those not familiar, Foot Locker is a global sneaker and sportswear retailer which owns a portfolio of brands including Foot Locker, Champs Sports, Eastbay, among others. FL maintains a 3,000 store footprint, which is primarily mall-based (woof) and makes its employees dress like referees.

Why FL? Why Now?

I thought you'd never ask. A few weeks back, FL's stock dropped ~25-30% in connection with its Q4 earnings release where FL management announced Nike was pulling back on some of its merchandise allocation to the retailer. Investors understandably panicked and sold out as Nike comprises 75%+ of FL's merchandise.

Talk about supplier concentration - FL has it in spades! Management guided that beginning in Q4 '22, lower Nike allocations will force FL's concentration of Nike products will drop to ~50-55% (vs ~75% today). Management believes FL will be getting smaller volumes of Nike's prized products (i.e., Air Jordans) in connection with Nike's continued efforts to build its direct-to-consumer (DTC) offering.

The Nike relationship and the risk of getting de-emphasized as a channel partner has been an overhang on FL's stock for years. Well, the dreaded time has come, and now the question for investors becomes:

Most professional investors talking about a name like Foot Locker would customarily dismiss the idea with a quippy saying like: "Life's too short for a trade like this" or "Good price alone does not a good investment make". They may be right - but I'm going to flush out a thesis for you, and you can decide how compelling it is. (as an aside, this thesis is still in 'draft' stage, I will look to refine this further as more research is conducted).

The Upside Opportunity at Foot Locker:

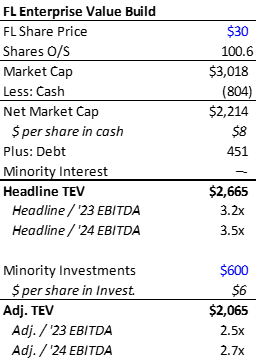

FL is an ~$8bn revenue and ~$800mm EBITDA (10% margin) business. Headline Enterprise Value is ~$2.6bn based on a current share price of ~$30. FL is currently trading at ~3.0-3.5x fwd EBITDA and ~5x fwd EPS. This is absurdly cheap, by any measure. For simple comparison, the S&P 500 index right now has a P/E ratio of ~34x! For those dubious of traditional accounting short-hand, Levered Free Cash Flow (LFCF) Yield is ~15%.

But wait - FL is even cheaper than it appears. FL owns two meaningful minority investments: (i) a ~20-25% stake in a high-flying, Unicorn start-up called GOAT and (ii) a 10% stake in a publicly-traded Israeli sports retailer cleverly called "Retailors".

These minority investments are collectively worth ~$700-800mm. GOAT, in particular, has been a home run since FL first invested back in 2019. If we back-out the value of these non-operating assets from the market cap of FL... the current share price for the core FL retail business becomes even cheaper. For the purposes of this write-up, let's say conservatively that the fair value of these minority investments are ~$600mm (25% discount to book). This $600mm of value equates to ~$6/share (~100mm shares o/s) so you're really buying the FL retail business at an Enterprise Value of $2bn, which is ~2.5x fwd EBITDA. By the way, fwd EBITDA is already factoring in a significant reset of the business below the banner year in 2021.

Here is a summary of my valuation ramblings above:

This is ridiculously cheap! Look - I'll be the first to admit this is not a great company, but I'm not sure it deserves this current price.

Oh, and I'm not done. On top of current trading levels, management on the last earnings call refreshed a $1.2bn share repurchase plan, which if it were fully utilized, at current prices could retire 40% of the company's outstanding shares. This is a particularly important point to the story because a buyback serves as a much needed catalyst for share price dislocation to be normalized.

Oh, and on top of that, management also announced a dividend of $0.40/quarter, which equates to a ~5% yield at current prices.

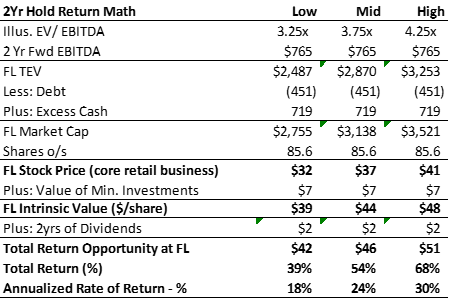

Here is the return math for an investment in FL if this thing trades to levels I would consider 'bottom of the barrel' for public retail names (~4x EBITDA). Management has its work cut out to convince the street that this is a viable go-fwd business, but if they can, investors are staring at 50%+ upside on Foot Locker at current prices.

Normally it is here I'd lay out thoughts on the underlying retail business, but I'm already 1,000 words in and haven't even touched the risks. I may follow up with a more fulsome de-brief later, but for now, the downside needs to be examined... and there is plenty to dislike about this business and its model in general. I'll attempt to navigate the focal points:

Where are the Risks?

The retail business is a tricky business to get right. You've got expensive leases, limited shelf space, evolving consumer taste & merchandising trends, large up-front inventory investments, and as we found out with Nike - sometimes a lack of negotiating leverage with big brands. Let's examine a few of these:

The Nike Risk - Nike has been keen on investing in its DTC presence by opening up stores in big cities with Class A real estate. As a sense of scale, Nike has ~250 stores in the U.S. vs. Foot Locker which has ~800. While its conceivable that Nike eliminates all allocations to Foot Locker, the more likely scenario in my view is that Nike gradually pulls back SOME allocation from Foot Locker over time. Nike is focused on creating a premium consumer retail experience, so the immediate priority for them is to create greater exclusivity around its retail offering, which means less premium product for its channel partners like FL. With this in mind, it seems unlikely at this stage that Nike will go and replicate the FL retail footprint, by going into class B and C areas to sell product. This move by Nike would bring much higher execution risk and likely lower ROIs given box-level economics in less affluent locales. I expect FL to be a more 'mainstream' Nike merchandiser going forward which I expect will change the gross margin structure of the business. The knock-on effect of this problem for FL (if it has less premium product), is determining the potential impact to foot traffic and basket sizes.

My biggest concern here is that FL makes meaningful inventory investment in new products -> customer foot traffic goes down because FL loses its cache as having the "hottest sneakers" and FL has to take massive markdowns to move undesirable inventory. This is certainly a greater than 0% probability event and is the key risk in this stock.

The Mitigant - Foot Locker will have ~12-24 months to initiate a successful pivot away from its reliance on Nike and diversify product mix to showcase Adidas, Reebok, Puma, as well as FL's private label apparel brands (which carry higher margin). Management knew this day was coming, and has been working on setting the stage for this transition to be as smooth as possible. The good news is that as investors, we should have some level of visibility into this transition and cut bait if it goes sideways. In its recent Q4 earnings release, FL reported that 'Non-Nike' sales comps posted +30% results (vs 1% comps for FL sales overall)... not a bad start.

Lease Risk - With over 3,000 stores worldwide, Foot Locker is actively managing a sophisticated retail lease portfolio. This is still a brick-and-mortar business in an increasingly digital world. Large rent payments on square footage with lower sales productivity can be a dangerous financial anchor. Currently rent expense comprises ~$750mm of annual expense for FL (~9% of revenue).

The Mitigant - Management has done a nice job of lowering the avg lease life to ~3yrs across the footprint and increasing its store mix to off-mall locations (~20%). This will allow the company to stay relatively opportunistic with store closures and limit breakage costs if sales volumes go to hell.

Inflation Risk - While not unique to FL, we can't ignore the impact that inflation can have on a discretionary consumer business. While sneakers and athletic apparel do have positive demand tailwinds relative to formal attire (thank you covid), its still a category that will get pinched if consumers broadly adopt a more conservative budget. Real costs to every consumer (food, gas, housing) is surging +7% over prior year levels, so we have to consider a demand reversion is on the table here which could certainly add risk to the cash flow story.

This is why investing is so fun to me, the weighting and balancing of multiple conflicting variables which can lead to completely different decisions and outcomes.

The Wrap-Up On FL

Ultimately, in light of the merits/risks here, I think FL is a buy at this time. I can hang my hat on:

- A fortress balance sheet ($800mm cash, $400mm of debt, gross leverage of 0.5x) to weather downside sales scenarios

- A proactive mgmt. team which is looking to take advantage of the current pricing dislocation and create shareholder value through share buybacks

- A scaled business which is a cash machine generating >$300mm of FCF to equity

- Minority investments provide a value backstop + future option value

I certainly acknowledge that I may look back on this write-up in 12 months and realize that I fell for a 'value trap'. Foot Locker is a business that is at best a flat top-line business, but more realistically a top-line decliner. But my current thesis is that prudent leverage, coupled with thoughtful capital allocators in the c-suite can harvest value for shareholders in this mature business.

Weekly Gratitude

Gratitude helps cultivate a sense of joy and appreciation along the way, and need not be reserved for the big or elaborate happenings in life.

This week I'm grateful for the greenery and mountain landscape surrounding my house during daily walks

What are you grateful for this week?

Update on Stock Picks:

Weekly performance update for active stock picks

If you enjoyed this, please share with 1 person you think may enjoy it too! It'd mean a lot to me!

Until Next Week,

Ryan ✌️