Friday🔥04: Food Delivery Economics & The Importance of Cherishing Boredom

Welcome to the 2 new additions to our Friday 🔥 community who have joined us since last week! If you aren't subscribed, join >100 smart & curious folks here:

Welcome to this week's edition of Friday Fire, an end of week newsletter recapping notable insights and inspirations from the past week. This week I'm unpacking the unit economics of the food delivery ecosystem and why a lack of boredom in your life could be blocking you from more of what you truly want. Let's jump in!

The Economics of Food Delivery

TLDR: DeliveryCos and Restaurants have created a symbiotic relationship. DeliveryCos are able to command revenue capture rates of 20-30% for driving additional order volumes to the restaurant. Restaurants generate 60%+ food-level profit margins given a kitchen's fixed cost, so they're willing to pay it. Consumers are effectively carrying the courier/delivery cost 1:1 through additional fees.

In recent weeks I've been researching companies in the food delivery space (DoorDash, UberEats, Grubhub, etc.). During this course of time I've become more familiar with the business model and how value is distributed between the Restaurant, the Delivery Platform ("Delivery Co") and the Consumer (i.e., me on the couch). Here is a breakdown of what you need to know about the economics of food delivery:

Restaurant <> Delivery Platform: As a consumer, this relationship is bit opaque... All we see is the total bill hitting our credit card, but what's happening on the backend?

DeliveryCo's have been on a tear in recent years, rapidly aggregating their collection of partner restaurants in order to create a differentiated offering & in-app experience for the consumer. Underpinning the restaurant logos you see when opening your favorite food delivery app is a commission agreement between the Restaurant and the DeliveryCo.

Typically, these commission agreements are non-exclusive (i.e., In N' Out can sign agreements with Uber Eats & Grubhub). Historically there were attempts made by DeliveryCos to create a catalog of exclusive restaurants, but the idea never gained traction in the U.S. as restaurants don't realize much economic benefit from constraining order flows to just one platform.

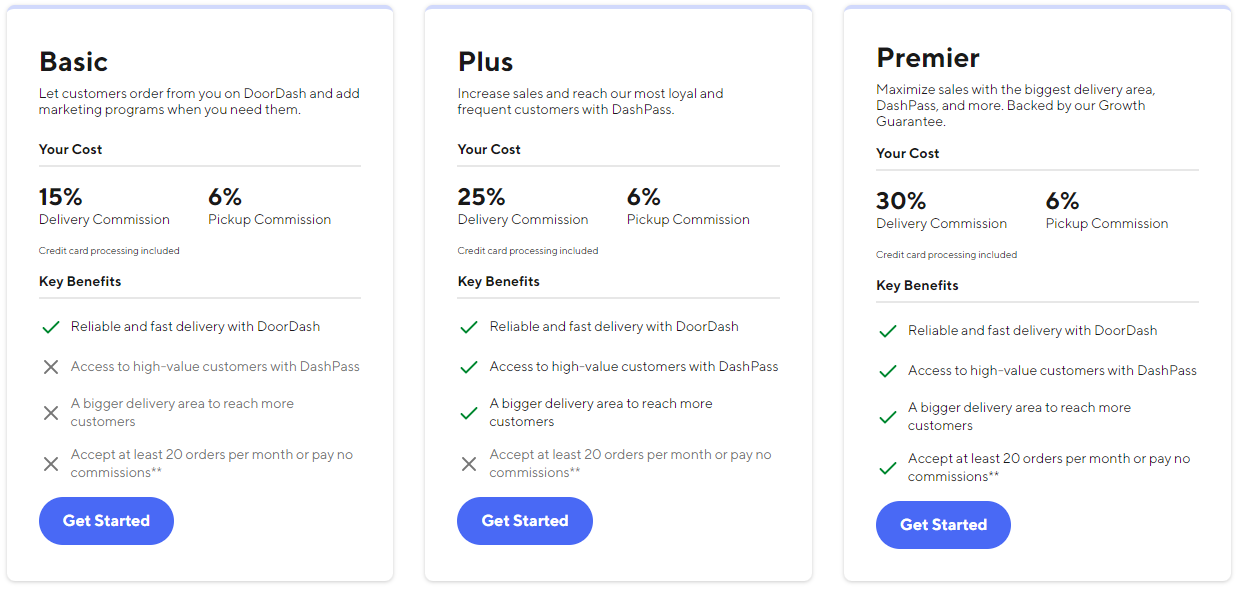

In terms of pricing, competition has reigned in DeliveryCos and resulted in near identical commission structures (i.e., restaurants aren't getting a better deal from one DeliveryCo to the next). An interesting anecdote: in April 2021, DoorDash launched an updated 3-tiered pricing structure (discussed below) ... and less than 6 months later (Sept 2021) Uber Eats had realigned its entire offering to match DoorDash, literally a line-for-line copy. The market is starting to rationalize, no DeliveryCo is looking to be play the low-cost leader with restaurant partners. Here's how the agreements work:

There are effectively 3 commission tiers of which the restaurant has the option to choose. The entry-level tier offers a 15% commission but comes with drawbacks (higher consumer-facing fees, restricted access to a DeliveryCo's subscriber base, lower restaurant in-app placement). Conversely, the premium tier (30% commission) allows direct access to the subscriber base (i.e., platform's highest frequency consumers) and also lowers the customer-facing fees, thereby creating a more frictionless user experience.

If you thought you were being served up arbitrary local restaurant options when you visited DoorDash, think again. The restaurants you see popping up multiple times in your feeds have just inked a more lucrative commission agreement with the DeliveryCo. DeliveryCo's are incentivized to push more orders through the network and they are going to direct traffic to more profitable restaurant partners when they can.

In transactions where you yourself perform the pickup (and just use the DeliveryCo platform to place an order), a DeliveryCo takes ~6% commission on the order. This pickup commission used to be a larger component of these business models 5 years ago, and was honestly a tremendous profit center (consumer is bearing the cost of fulfillment). But, at the end of the day, culture continues its slide toward convenience and I'd expect to see pickups become a gradually smaller % of the market over time. Here is screenshot of the DoorDash pricing tiers described above:

These are some rather hefty commission fees extracted by the DeliveryCo, so I did some digging into why restaurants are clearly willing to pay it...

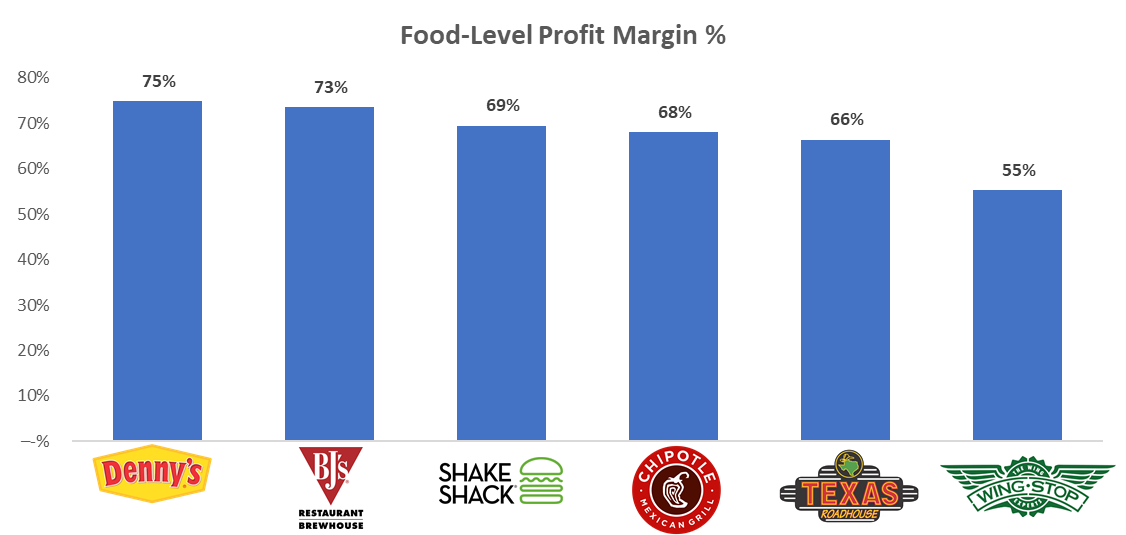

I did not appreciate how high the food-level margins are in the restaurant business. Restaurants generate 60-70% food-level margins on any given order! (based on my review of several publicly traded RestaurantCos). Of course, not all restaurants are created equal, so local gems like 'Gregg's Eggrolls' (fictitious Chinese eatery) won't have the same profitability profile as a national chain, but the implications are the same...

Wild to think that Chipotle is making $7 on every $10 burrito I buy! You're $30 dinner tonight will only cost the restaurant $9 to make. For this discussion on food delivery, we can largely ignore all fixed costs here (Labor, Rent, Utilities) because restaurants are paying those fixed costs regardless. DeliveryCos are just flowing incremental order volume through a fixed cost kitchen.

Next, we'll touch briefly on the consumer-facing side of the platform, but this is already well known by any existing users.

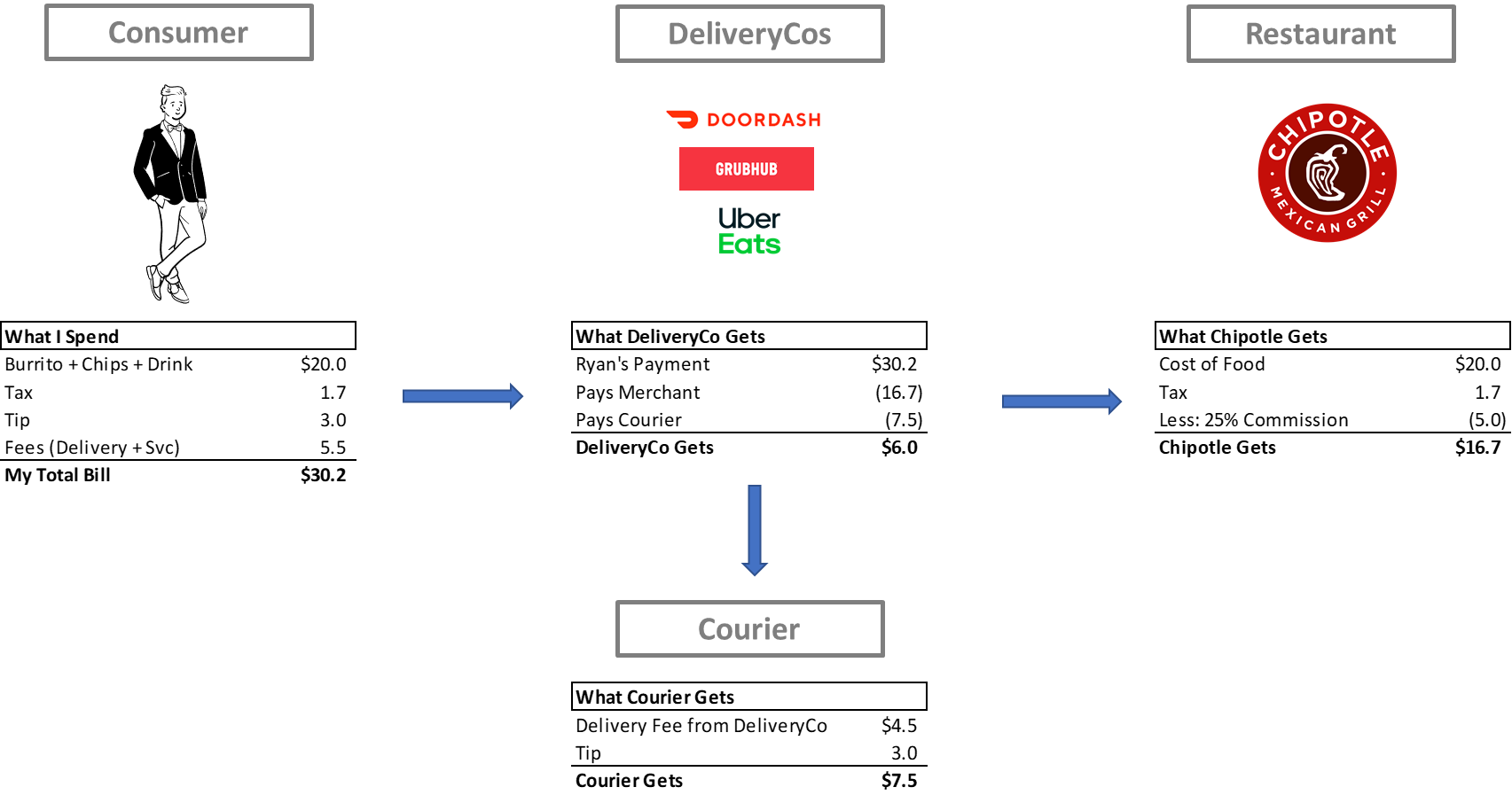

Consumer <> Delivery Platform: The DeliveryCo's charge two primary fees to the consumer: (i) a Service Fee and (ii) a Delivery Fee.

The Service Fee is charged by the DeliveryCo and will very depending on your order size, typically ranging from $1-5. These Service Fees are helping to defray transaction costs (i.e., credit card fees paid by DeliveryCo) and support the DeliveryCo app infrastructure. This Service Fee stays with the DeliveryCo as revenue.

The Delivery Fee is determined by a combination of: (i) the commission agreement selected by the restaurant (mentioned above), (ii) consumer distance from the restaurant and (iii) courier availability. From what I can tell by looking at public filing footnotes, it appears this delivery fee is largely going to offset the cost of the courier and is not a true profit center for the DeliveryCo.

Here is a finger painting of the math behind my $20 Chipotle order:

So... what's on the horizon for this ecosystem? New delivery channels (convenience stores, grocery, entertainment venues, etc.) provide tantalizing new addressable markets for the DeliveryCos which could deliver (pun intended) greater route density. Greater route density is important because it enables ⬆️orders per courier, creates ⬇️pressure on delivery fees which ➡️increased consumer order frequency. Talk about a powerful flywheel.

Cherish Boredom

During my reading this week, I was confronted with the idea that boredom is inexcusably absent from our daily lives. You read that right - the premise was "You're Not Bored Enough!"... color me intrigued.

The argument goes...

We have systematically worked boredom out of our lives.

- On an painful conference call? (go look at Facebook)

- Waiting in line at grocery store? (read a twitter thread)

- Plot of your Netflix show taking too long to build? (play Candy Crush)

- Sitting on the throne? (scroll LinkedIn)

...You get the picture. By and large, we are intolerant of experiencing a modicum of boredom!

Learning hard things is a non-glamourous process which invokes frustration and often times, boredom. Think about something you've tried to learn recently. I bet at the beginning it was exciting, but as the novelty wore off, you had: (i) to think critically and (ii) perhaps begin consulting sources with more information density than Business Insider & Reddit. In this process, you likely experienced boredom - and what did your brain urge you to do when learning wasn't fun and exciting? I'll tell you what mine does, seek distraction! By Any. Means. Necessary.

This week, I outlined out a few small practices to try and increase my boredom tolerance. Here are a few of them:

- Turn-off my podcasts when grocery shopping

- Stop watching YouTube videos while eating breakfast

- Eat lunch outside, with my phone inside

- When I'm waiting in line, don't use it as a time to catch up on text messages/email responses

I don't know what the long-term outcome from this approach will be, but I can tell you after just a week under my belt, I'm already noticing uplift in my ability to stick with tough problems a little longer.

If you want to differentiate in your chosen field, consider cherishing moments of boredom. Boredom can be used to train the mind so that when you need to learn something hard, you have a chance to stick with the research long enough to reach the other side, and not get derailed by boredom.

Gratitude

Gratitude helps cultivate a sense of joy and appreciation along the way, and need not be reserved for the big or elaborate happenings in life.

- This week I'm grateful for a lovely take-out dinner from Din Tai Fung with my wife. This restaurant (chinese dumplings) is bomb and if you ever have the chance to dine here, take it!

What are you grateful for this week?

Update on Stock Picks:

Weekly performance update for active stock picks

If you enjoyed this, please share with 1 person you think may enjoy it too! It'd mean a lot to me!

Until Next Week,

Ryan ✌️