Friday🔥 10: Musk We Talk About Twitter?

Welcome to the 2 new additions to our Friday 🔥 community who have joined us since last week! If you aren't subscribed, join >100 smart & curious folks here:

Welcome to this week's edition of Friday Fire, an end of week newsletter recapping notable insights and inspirations from the past week. This week I'm unpacking Musk's case for steering Twitter away from a subscription-based business model. Let's jump in!

Don't Tread on Ads

In case you've been living underground for the last two weeks, Elon Musk is buying Twitter. This whole Twitter takeover saga started off as an intriguing SEC filing from Musk on April 4th which revealed he had taken a 9% interest in the social media platform.

Musk would later announce (only 10 days later) that he made an offer to buy Twitter... you have to appreciate the irony that he made his public announcement about acquiring Twitter on Twitter.

Elon's deal valued the business at $54.20 per share, with Elon not missing a golden opportunity to pay homage to cannabis culture (4.20). The share price reflects an enterprise value at TWTR of ~$45bn, and represents ~20% of the icon's net worth ($264bn). Musk is using a fair amount of debt (~55% of total capitalization) to fuel the deal, so he's only coming out of pocket for a total of ~$21bn. Casual.

Musk has publicly touted that he "doesn't care if Twitter makes money". He has positioned himself as the champion of free speech and his public distaste of advertising is well documented. This has led some to speculate, 'could we see a pivot in Twitter's business model (and fundamental user experience) as a result of the takeover?'

As I see it, there are two clear variables which inform the flaws of a subscription-based business model pivot at Twitter.

1. Conversion of free users to paid subscribers

This is the key financial question for Musk and the lack of any similar scaled social media subscription businesses makes for tricky comparisons.

One way we could think about this is by looking at the newspaper industry. The newspaper business has historically been an ad-based business, focused on broad circulation and reach. As the internet bolstered consumer access to quality content, newspapers were forced to shift to a subscription-first model and away from its advertising roots.

This newspaper business model analog example is made even more interesting by the fact that "getting the latest news" is the number 1 reason people use Twitter (according to recent polls).

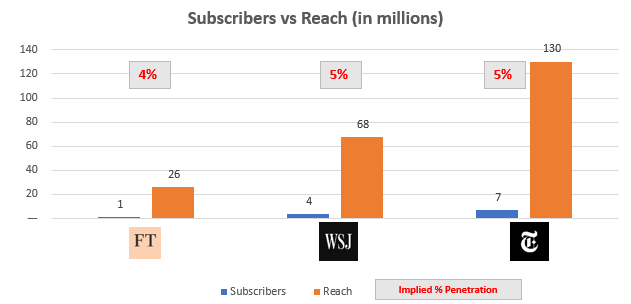

One way I think about the potential subscriber base at Twitter is by looking at the reach (circulation) of newspapers and comparing that to their subscriber base.

Looking at the reach/subscriber dynamics for three of the largest publishers in the world, the relationship becomes clear

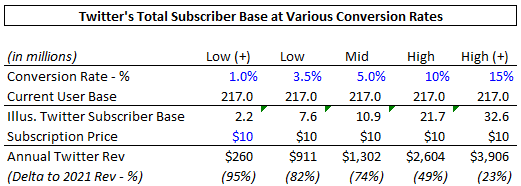

The punchline: these very established businesses have been able to convert only ~4-5% of its audience into subscribers. If we look at the current subscriber base for Twitter - similar conversion rates would imply a catastrophic outcome for its new owner.

If Twitter is not capable of generating a differentiated conversion rate from analogs in other industries, a shift to subscription would represent meaningful downside risk to the Company's current revenue (in the neighborhood of 50% potential declines).

Outside of the obvious financial implications, there is powerful qualitative factor unique to social networks which undermines the efficacy of a subscription model.

2. Network Effects Require a Large Network

I'm sure you've heard the buzzword, Network Effects... the term is commonly used to describe a phenomenon where the more frequently a product/service is used, the more valuable it becomes. Some of today's great companies are case studies for the power of network effects: Facebook (more friends online means compelling user experience), Uber (more drivers means lower fares for riders), Amazon (more 3rd party sellers means better selection and prices for customers).

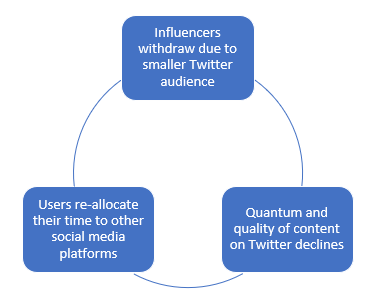

No social media company has embarked on a subscription model because it knee caps the power of network effects. If you are constraining your total user base to only those willing to pay, the value of the platform declines as the number of users actively tweeting contracts.

Think about how many of the current 217mm users are there solely to follow celebrities, politicians or thought leaders. If those influencers all of a sudden have their audience reach cut due to subscription requirements, how much time do you think those influencers are going to continue to invest in their presence on Twitter's platform?

Lower time and content investment from influencers will certainly lower the user experience, which will lead to increased subscriber churn... perpetuating a vicious cycle

I think its safe to assume Musk will keep Twitter as an open, ad-based business for the foreseeable future.

For Musk, the real challenge will be elevating the Twitter user experience to ultimately show advertisers that its die-hard user base can compete with the attribution, targeting, measurement and purchase intent of the current social media titans (Facebook, YouTube and now Tik Tok).

Gratitude

Gratitude helps cultivate a sense of joy and appreciation along the way, and need not be reserved for the big or elaborate happenings in life.

This week I'm grateful for the power of compounding (in relationship & in learning)

What are you grateful for this week?

Update on Stock Picks:

Weekly performance update below for active stock picks. The market has been beaten up in the past few weeks (down 3-4%). MAPS has re-traced its prior gains and FL is largely unmoved.

If you enjoyed this, please share with 1 person you think may enjoy it too! It'd mean a lot to me!

Until Next Week,

Ryan ✌️